Fantastic Tips About How To Appeal Property Taxes Nj

If the petition of appeal form is downloaded, remember that one copy must be served on the mercer county board of taxation at 640 south broad street,.

How to appeal property taxes nj. Our mission is to facilitate secured and efficient electronic filing and management of property assessment. If you are not satisfied with the decision made at your county tax board hearing, you can file an appeal with the tax court of new jersey. If the county assessed your property value at $750,000 or higher, you must appeal directly to the tax court of new jersey for a property tax adjustment.

Property tax appeal procedures vary from jurisdiction to jurisdiction. Challenging your property tax assessment is not an easy process. If the property is assessed for more than $1,000,000.00 the taxpayer can appeal directly to the n.j.

Income and expense statement (pdf) taxpayers bill of rights (pdf). Ad compare tax preparation prices and choose the right local tax accountants for your job. Welcome to nj online assessment appeals.

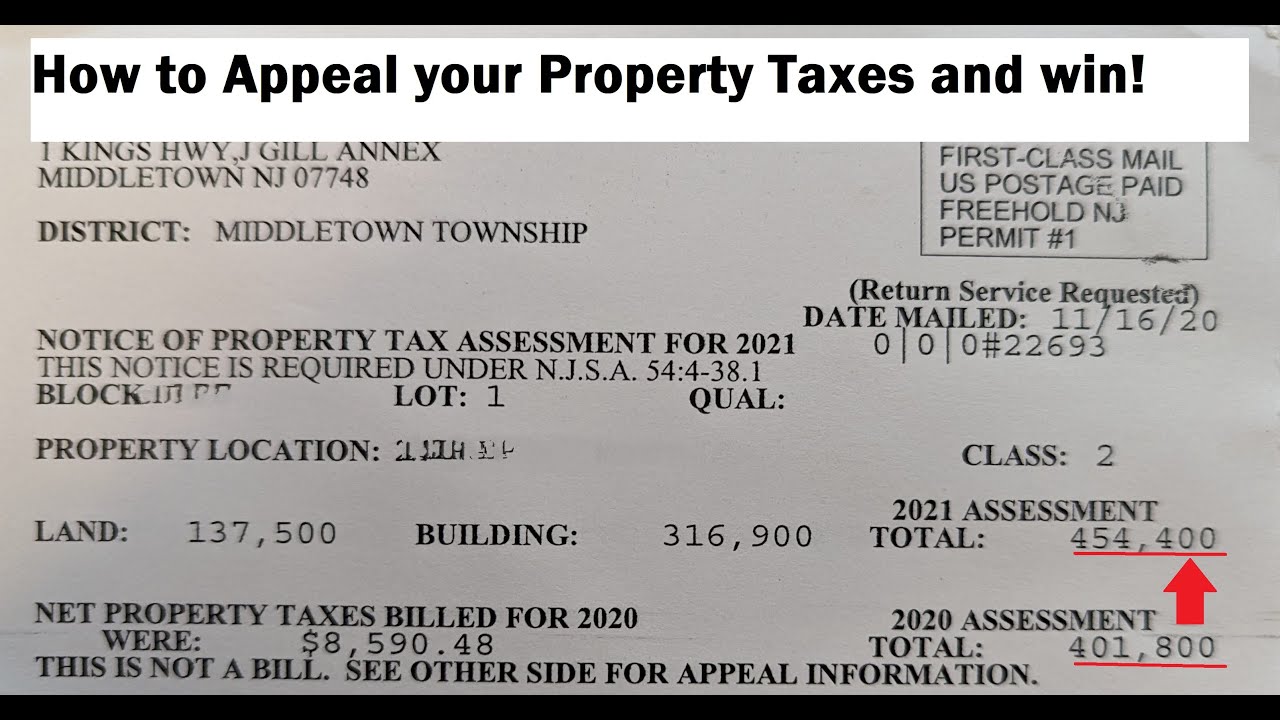

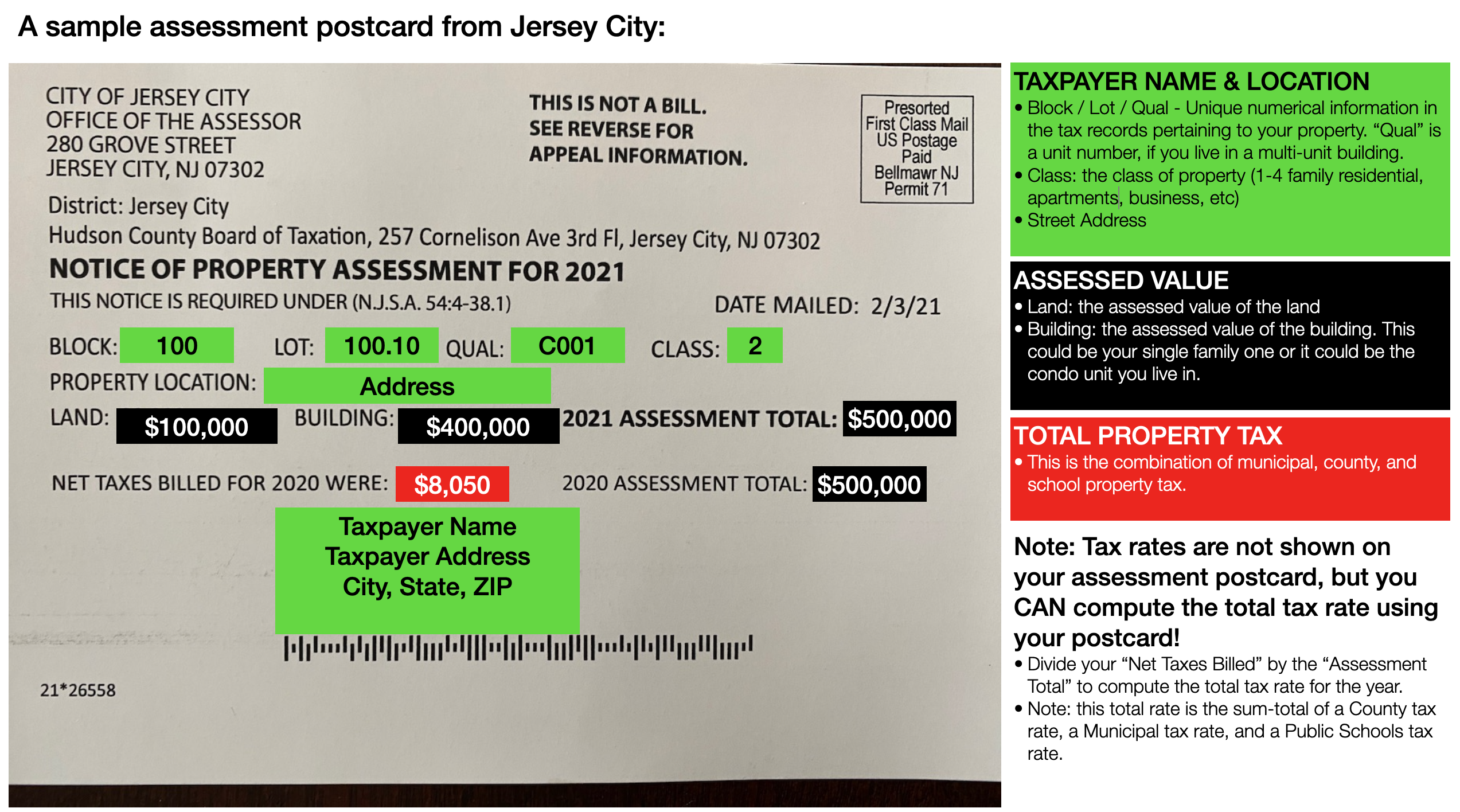

Ad find property tax appeals nj. True market value standard —all assessments must be 100% of true market value as of october 1 of the previous year. Remember your home’s value determines the taxes on your home.

File your appeal with tax court within. The deadline for filing a property tax return can range anywhere from 30 to 120 days; If you are not satisfied with the decision made at your county tax board hearing, you can file an appeal with the tax court of new jersey.

If you are dissatisfied with the judgment of the bergen. A taxpayer considering an appeal should understand that. An appeal is made by filling a complaint with the tax court of new jersey.