Supreme Info About How To Improve Credit After Bankruptcy

Ad sign up today to start building your credit & savings with getbuild.com.

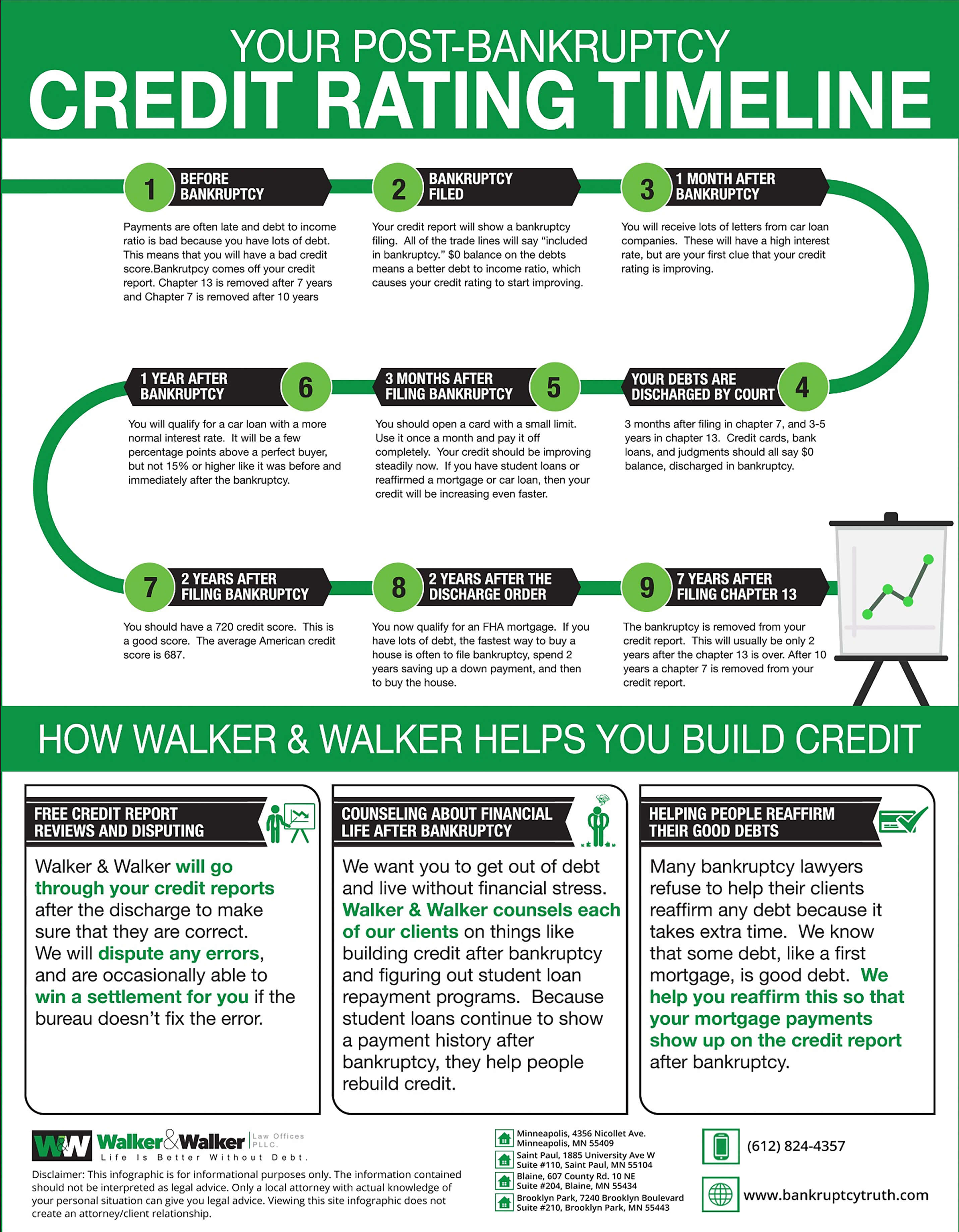

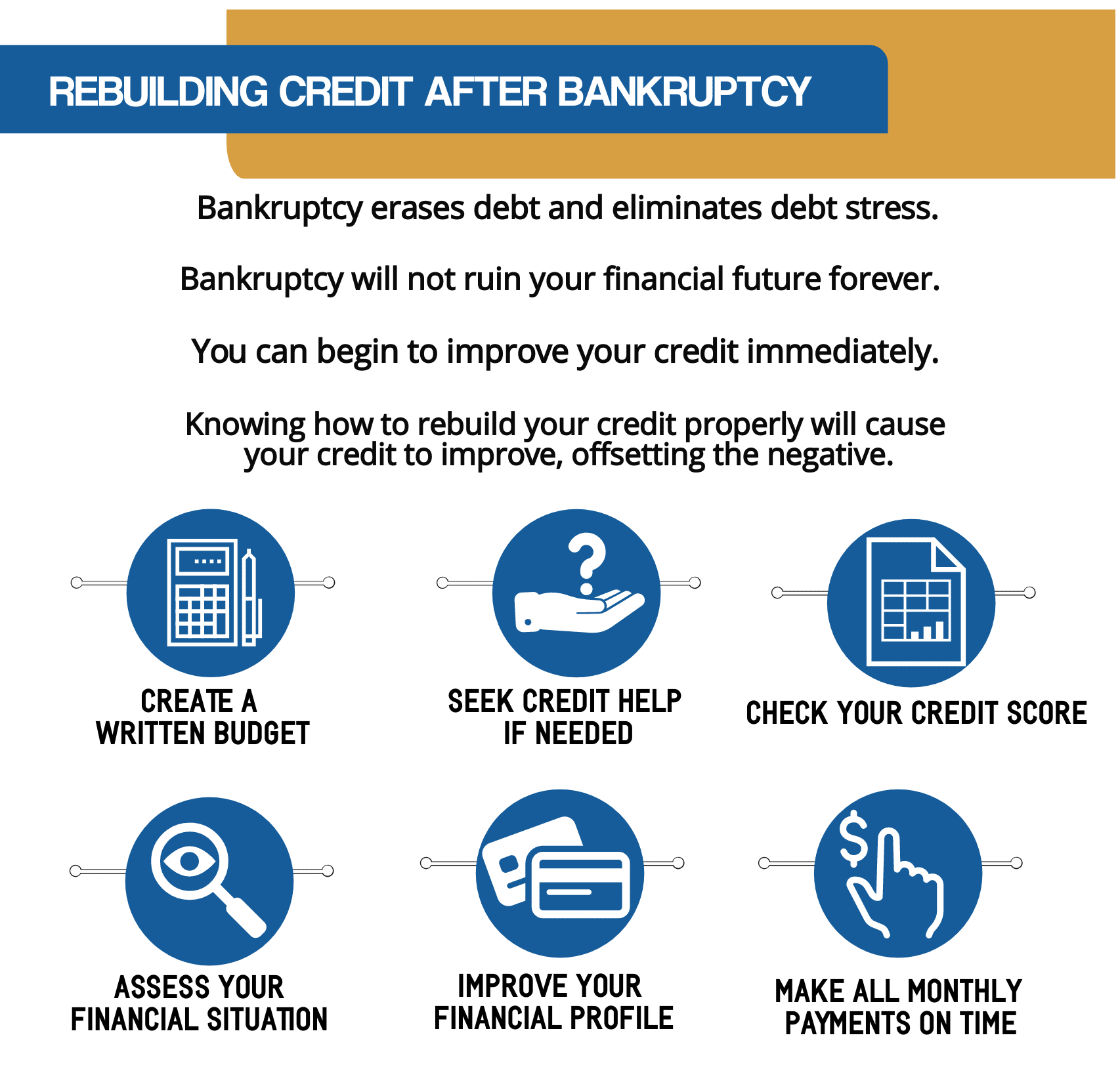

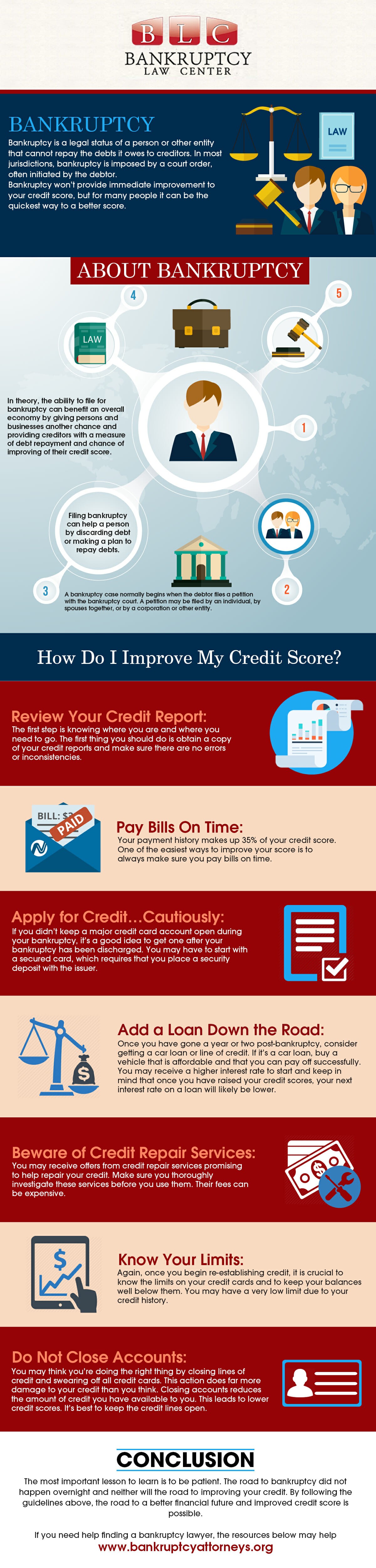

How to improve credit after bankruptcy. The debts that used to weigh you down and damage your score, are now resolved. Pull your own credit report at least once a year; Ad responsible card use may help you build up fair or average credit.

5 of the best credit cards after bankruptcy 3. Auto loans can also be very helpful in rebuilding your credit after filing for an arizona bankruptcy. After bankruptcy credit repair, how long after bankruptcy does credit improve, building credit after bankruptcy, getting credit after bankruptcy, after bankruptcy credit card, best credit card.

Another critical step to improve your credit is to monitor it at least every six months. After reaching 600, one to two years after bankruptcy, if you continue to practice good credit habits, your credit score will continue to gradually improve. Use credit cards (wisely) 3.

Find a card offer now. Rebuilding credit after chapter 7, how long after bankruptcy does credit improve, get a credit card after bankruptcy, how to repair your credit after bankruptcy, building credit after bankruptcy. In the meantime, you can start improving your credit right away by.

One of the easiest ways to improve your score is to always make sure you pay bills on time. Before you commit to bankruptcy, be sure that you have done all you can to climb out. Here are a few rules of thumb to build credit after bankruptcy:

How to improve your credit score after filing bankruptcy in michigan. Build your credit and increase savings with our unique credit building system. Except for those driven to bankruptcy by unforeseen events or unavoidable catastrophes, the.